tax strategies for high income earners book

Ive only Call us now. Tax strategies for high income earners.

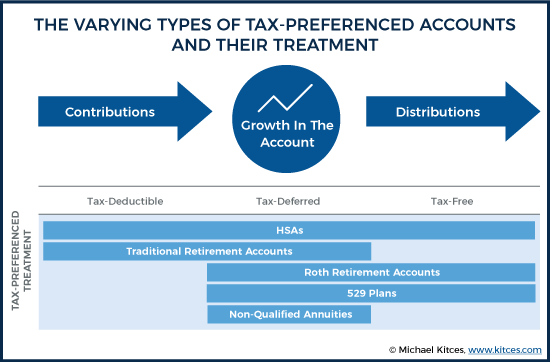

The Hierarchy Of Tax Preferenced Savings Vehicles

If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA.

. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. Since high net worth individuals are also high-income earners they need to deal with a higher tax burden. Fortunately there are a number of tax reduction strategies available to high earners and in this blog post we will discuss some of the most effective ones.

Timing Gains and Itemized Deductions. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions. We will begin by looking at the tax laws applicable to high-income earners.

If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA. A Solo 401k for your business delivers major opportunities for huge tax deductions every year. What follows are tax strategies that some high-income earners utilize.

For 2021 the IRS Solo 401k contribution limit is 58000 before eligibility for catch-up contributions. Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. One of the tax reduction strategies for high income earners that i think a lot of people dont fully understand is selling inherited real estate.

5 Reduce Taxable Income with a Side Business. If theres potential for a high return by investing a smaller amount of money upfront Roth can be the way to go. Any contributions made to tax-free savings accounts grow tax-free and.

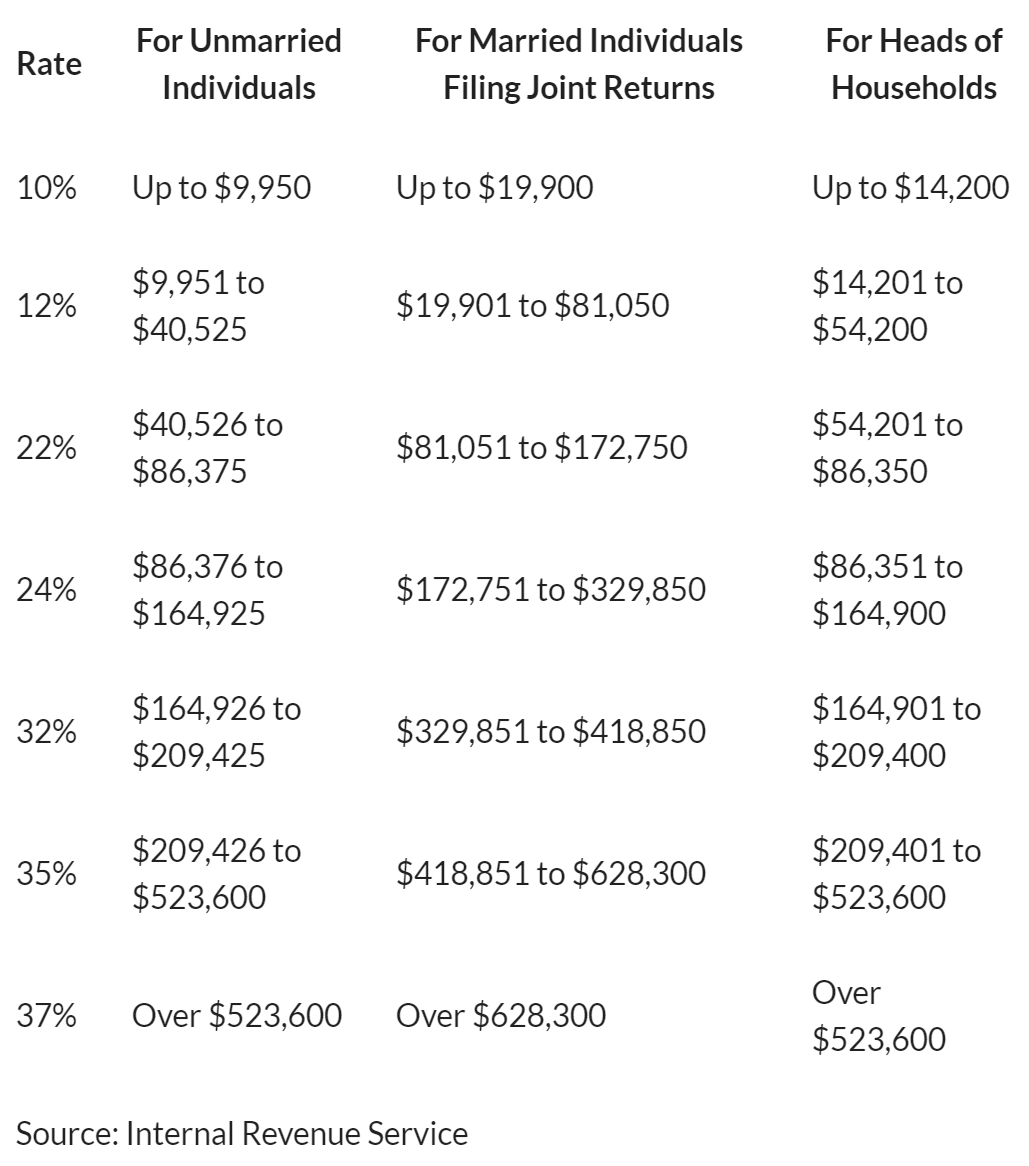

196000 to 206000 if youre married filing jointly The limits on deducting long-term care premiums also increased to 5430 per person for those ages 71 or over and 4350 for those ages 61 to 70. The progressive tax system ensures that an individuals taxes are calculated based on their taxable income. A couple of weeks ago one of my clients asked me to read Dave Ramseys book The Total Money Makeover.

Regardless of whether you are an. Tax strategies for wealthy. Just as it sounds this option allows high earners to bypass the income limits and still utilize the tax advantages of a Roth IRA account.

The change applies to high-income individuals who make additional contributions to a retirement program during a. These deductions are allowed even if you take a standard deduction and help you qualify for other credits on your return. So what are the top tax planning strategies for high income employees.

Opening a Solo 401K is Among the Important Tax Saving Strategies for High Income Earners. Invest in a Tax-Deferred. Your best bet is to talk with your accountant and financial advisor to get their input based on the current year.

If youre a very high income earner this wont save you a ton on taxes. You should have this conversation yearly well before the end of the calendar year. Lets dive into three tax-saving strategies for high-income earners.

You may also like. For most investment strategies trying to time the market is inadvisable at best. High-income earners make 170050 per year in gross income or 340100 if married or filing jointly.

If youre looking for another way to avoid paying higher taxes now then it might make sense to defer taxes on realized gains. As a high-income earner its vital to have a comprehensive understanding of the tax laws that apply to you. Contributions now phase out at 124000 and 139000 of modified adjusted gross income.

As a refresher for 2021 FY the individual tax rates including medicare levy are. Frequently Used Tax Strategies for High Income Earners Family Income Splitting and Family Trusts. Once you have the right team of financial professionals who understand your financial situation there are some investment strategies you may consider using this year.

Invest in Tax-Free Savings Accounts TFSA. Once you have the right team of financial professionals who understand your financial situation there are some investment strategies you may consider using this year. One of the most frequently used techniques to lower a high-income.

4 Important Tax Strategies for High-Income Earners Max Out Employer Benefits and Education Accounts. However lawmakers change tax codes regularly both temporarily and permanently. Scottish taxpayers will continue to be subject to income tax at 5 different rates ranging from 19 Starter Rate to 46 Top Rate for any income in excess of 150000.

But its one of the simplest tax strategies to employ if youre not currently maxing out on it. To create a backdoor Roth IRA youll need to. An overview of the tax rules for high-income earners.

Contribute to your Superannuation Fund. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. Strategy 2 Defer Taxes on Realized Gains.

The more taxable income you have the higher your federal income tax bill. Discover the proper strategy for avoiding estate tax that is best suited to your familys needs wants and goals in our published book 7 secrets to high net worth investment management estate tax and financial planning. But its one of the simplest tax strategies to employ if youre not currently maxing out on it.

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. If you are a high earner with an income above the IRSs income limit for Roth IRA accounts you still have the option to create a backdoor Roth IRA. By calculating your taxable income you can determine the amount of money you need to pay in taxes.

Additionally tax-deferred accounts benefit by compounding returns faster by sheltering income from current taxation. This is one of the most basic tax strategies for high income earnersthat you.

The 4 Tax Strategies For High Income Earners You Should Bookmark

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips As I P Roth Ira Finance Wealth Building

Tax Strategies For High Income Earners Pillar Wealth Management

Amazon Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Books

What Is Wrong With The American Tax System For The Middle Class Finance Organization Finance Planner System

Asset Protection For Business Owners And High Income Earners How To Protect What You Own From Lawsuits And Creditors Ebook By Alan Northcott Rakuten Kobo Higher Income Asset Business Owner

From High Income To High Net Worth Alternative Investment Strategies To Stop Trading Time For Dollars And Start Creating True Freedom Phelps Dds Dr David 9781733234542 Books Amazon Com

How Does A Backdoor Roth Ira Work Roth Ira Finance Saving Ira

High Income Earners Can Use This Tax Friendly Strategy To Save For Retirement Cnbc Tax Return Higher Income Saving For Retirement

Retirement Planning And Tax Savings For High Income Earners Chatterton Associates

Liberals To Go Further Targeting High Income Earners With Budget S New Minimum Income Tax R Canada

5 Outstanding Tax Strategies For High Income Earners

Episode 67 Investing For High Income Earners Wealthability

5 Outstanding Tax Strategies For High Income Earners

Amazon Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Books

Difference Between High Income Earners And Being Rich Amazing Inspirational Quotes Lessons Learned In Life Inspirational Quotes

The 4 Tax Strategies For High Income Earners You Should Bookmark

Amazon Com Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Audible Audio Edition Adil N Mackwani Will Stauf M A Wealth Audible Books Originals